The Value of a Second Opinion

The value of a second opinion has a real dollar amount. This is the story of a real client’s second opinion and why it can be critical to talk to more than one lender when shopping for a mortgage. We want to start by thanking Stephanie Olson for allowing E5 Home Loans the opportunity to provide a quote after they talked to another lender. Her story is not unique. But it illustrates what we mean when we say “E5 doesn’t charge a bunch of crazy fees.”

Here is Stephanie’s 5-star review of her experience with E5 Home Loans:

“We thought we had a mortgage company picked out, and they were great until they gave us the estimated closing costs, and they were insanely high. I gave them a chance to lower them, they wouldn’t so we called Larry Cappelletti at E5 Home loans.”

Stephanie adds, “Right away he cut the closing costs from $16,000 to $3700! He rushed the appraisal, and it came back quicker than he told us it would. In all, Larry communicated everything to us, and we were very happy with our closing costs which were actually $1000 less than originally quoted! We will be telling anyone who needs a loan to call Larry. Thank you!”

Here is a breakdown of how E5 was able to save Stephanie more than $10,000, which is what her second opinion was worth.

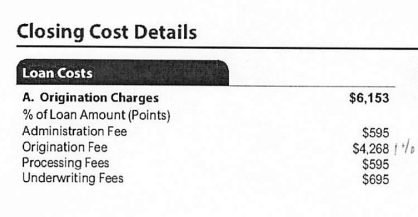

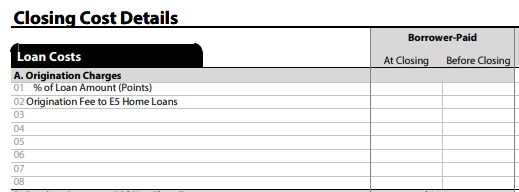

It’s common for other lenders to charge points, which is the equivalent of paying cash to have a lower rate. Many lenders’ “lower rates” while paying points are no lower than E5’s rates without points. Most lenders also charge application, origination, underwriting, and processing fees that can add up to thousands of dollars. E5 doesn’t charge any lender fees, and in the case of Stephanie Olson, she received the same exact rate from E5 as she was quoted with the other lender. E5 charged $0 in points, $0 loan fees, and provided a $3,962.94 credit to apply to other costs like title, taxes, and insurance. The other lender charged $6,153 with no credit to pay other costs. The difference is $10,115.94 in fees (2.37% of the loan amount) for the exact same loan and interest rate.

The extra amount Stephanie refers to which she did not expect was a $600 credit to pay her back for appraisal costs. For the rest of March, E5 Home Loans is providing up to a $600 credit towards appraisal cost on the purchase of a primary home. Even more savings!

Other lender’s loan costs: $6,153

E5 Home Loans Closing Costs: $0

E5 Home Loans is a mortgage broker which means we shop multiple lenders to ensure we find borrowers the best product at the most competitive rate.

We encourage everyone to take a page out of Stephanie’s playbook and call E5 Home Loans to get a second opinion. It may just save you $10,000.