Not All Rates Are Created Equal

The rise of interest rates this year ushered in more and more loan options, news articles and conversations about where rates stand and where they are going. It’s easy to read or hear something with a number like 4%, 5%, 6%. One number doesn’t tell the whole story, whether it’s in the media or when getting a rate quote.

If you’re shopping rates, it’s important to understand the loan term, loan type, what factors impact rates, and what points are (which can be the most important and least understood factor).

Points

We think it is important to start with “points” as this can be the most common and confusing part of shopping mortgage rates. “Points” are the cost of an interest rate. The amount of points is equal to a percentage of the loan amount. If a loan amount is $200,000 and there is a rate quote of 5.25% at a cost of 0.8 points. The cost of that rate would be $1,600 (0.8% of $200,000). In order to appear more competitive, lenders may quote a lower rate and charge 1 point as an origination fee, so the same scenario would be a 5.25% rate with a $2,000 (1pt) origination fee.

The opposite can also work towards a borrower’s advantage. Rather than paying a point, the borrower can opt for a higher rate and receive a rate credit. The rate could be 5.75% and they could receive a $3,000 (1.5pt) rate credit to be applied to other costs, such as the appraisal, title fees, or impounds. This tactic can benefit homebuyers with limited funds for down payment and closing costs.

The best advice we can give shoppers is to get a written quote or loan estimate that includes ALL fees associated with the loan. This will give you an apples-to-apples comparison. Also, be aware of online rate promotions. You can find a lender promoting 5.35%, but you need to read the fine print and understand that a specific rate may require 20% down payment, 740+ FICO score, AND cost points.

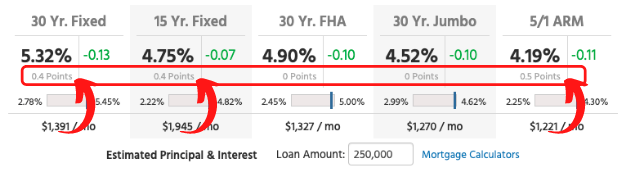

Here’s an example of 5 loan products with various rates, but 3 cost points and 2 do not.

source: Mortgage News Daily

Should I Pay Points?

One way to evaluate points is the repayment time. For example, if a point costs $2,000, and the difference in rate lowers the payment by $50/mo. The time to recoup that $2,000 investment is 40 months. If there is a chance you may be in the home or the loan less than 40 months, then there is no financial benefit to paying the point.

Term & Type

First, the term is simply how long the loan takes to repay. The most common term is 30 years, and the second most common is 15 years.

There are basically 2 types of loans, Fixed-rate and Adjustable-rate. Not surprisingly, fixed-rate loans have the same rate for the entire term of the loan. Adjustable rates can adjust during the loan term at pre-determined times, i.e. fixed for 5, 7 or 10 years, then adjust every 6 months.

Since lenders get re-paid faster, they offer lower rates for shorter terms. Currently, a 15-yr fixed rate can be as much as 0.75% lower than a 30-yr fixed rate.

ARMs

Adjustable Rate Mortgages (ARMs) are designed to offer lower rates than 30-yr fixed. With rates over 5%, ARMs have become much more common and can start with an introductory rate even less than a 15-yr fixed.

However, it’s VERY important for borrowers to understand the terms and risks associated with ARMs. The shorter the introductory term (typically 5, 7 or 10 years), the lower the rate. All ARMs will have regular adjustment periods after the intro fixed term. These regular adjustments typically occur every 6 – 12 months). The adjustments will also have “caps,” or the maximum amount the rate can increase during an adjustment period. There can also be a “cap” on the maximum amount a rate can increase over the life of the loan.

We can’t stress enough how important it is to have a loan officer explain all these factors when considering ARMs.

What impacts YOUR interest rate?

Most people realize the FICO score plays a significant factor in available rates for all loans and terms. The higher the FICO, the lower the rate. Your FICO is an indicator of risk and lenders will reward low-risk borrowers with better rates. Once a FICO score hits 740, borrowers typically are getting the best available rate for their score. For borrowers with FICO scores below 680, they can expect to take a higher interest rate or pay more for the same rate offered to a higher FICO borrower.

Another key factor is the Loan-to-Value (LTV), or how much down payment you bring to the table. 20% down, or 80% LTV will eliminate mortgage insurance. Getting below 70% LTV can provide even lower rates. Once you get to 60% LTV, borrowers are pretty much in the A+ category. The only incentive to put more money down would be to lower your monthly payment.

How to shop rates

It’s good to understand all rates are not created equal. It’s important to get a written quote and know rates change day-to-day and sometimes multiple times a day. Waiting 2 days between quotes in this market could provide 2 very different quotes. Remember to look out for lender fees, points, as well as the quoted rate for your preferred loan term and type.

E5 Home Loans is always happy to offer a second opinion with no obligation. More importantly, with no lender fees. And we shop your loan with multiple lenders, so we can compare all these factors to find the best loan for your situation.