No-Cost Appraisals* with 1-0 Temporary Rate Buydowns

With mortgage rates remaining high, E5 Home Loans is now offering No-Cost Appraisals* with 1-0 Temporary Rate Buydowns. Yet another way to help buyers save money and sellers sell their home faster. From now until March 31, 2024, we’ll cover the appraisal costs on all conventional and government loans when you utilize our 1-0 Temporary Rate Buydown.

Temporary buydowns can benefit real estate agents (sell listings without price reductions), sellers (houses can sell faster), and buyers get lower monthly payments at the start of their loan.

Benefits of temporary buydowns:

Get extra flexibility with a lower monthly payment using a Temporary Rate Buydown to lower the interest rate at the start of the loan. It’s a great option for almost any borrower, especially those who:

- Expect an increase in their income in the next few years

- Have excess seller concessions to use and want to take advantage of a low fixed rate

- Are looking to do renovations, make upgrades, or buy furniture for their new home

- Are going from renting to buying and want to ease into their mortgage with a lower payment

Temporary Rate Buydowns are available for:

- Conventional primary and second home purchases

- FHA and VA primary home purchases

- Select Jumbo Products

Choose between these Temporary Rate Buydown options:

- 3-2-1 buydown: Lowers the note rate by 3% in the first year, 2% in the second year, 1% in the third year, then back to the original note rate in the fourth year for the duration of the term.

- 2-1 buydown: Lowers the note rate by 2% in the first year and 1% in the second year, then back to the original note rate in the third year for the duration of the term.

- 1-1 buydown: Lowers the note rate by 1% in the first two years, then back to the original note rate in the third year for the duration of the term.

- 1-0 buydown: Lowers the note rate by 1% in the first year, then back to the original note rate in the second year for the duration of the term.

- Until March 31, 2024, E5 will cover the appraisal costs on conventional and government loans when you utilize our 1-0 Temporary Rate Buydown*

Information is subject to change. Certain restrictions apply. Subject to borrower approval.

*Eligible on submissions as of November 15, 2023. E5 will cover up to $600 of the appraisal cost.

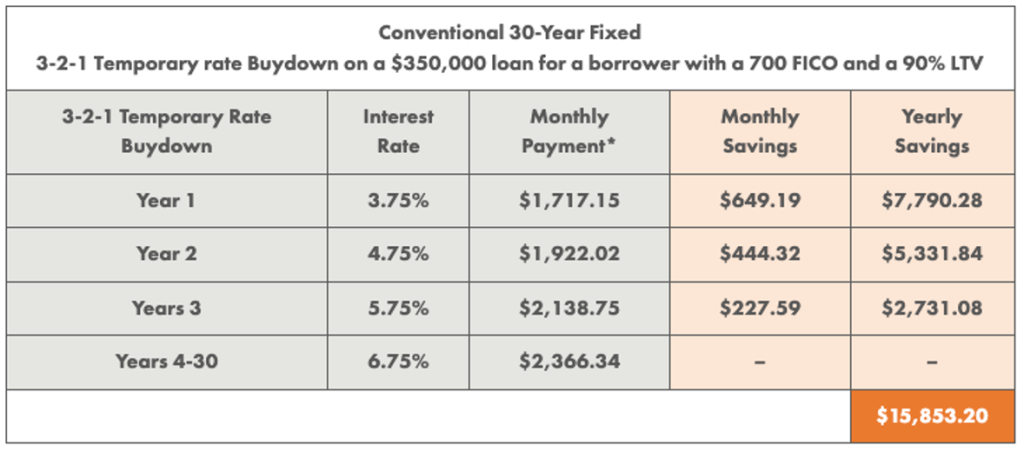

Here’s an example of the potential savings on a 3-2-1 seller-paid buydown:

*The principal, interest and MI payment on a $350,000 30-year Fixed-Rate Loan at 6.750% and 90% loan-to-value (LTV) is $2,366.34. The Annual Percentage Rate (APR) is 7.138% with estimated finance charges of $5,600.The principal and interest payments, which will continue for 360 months until paid in full, do not include taxes and home insurance premium, which will result in a higher actual monthly payment. Rates current as of 6/8/23. Subject to borrower approval. Some exclusions may apply.

- The borrower must qualify for the full monthly payment (before the buydown rate is applied)

- For the seller-paid option, seller concessions are deposited as a lump sum into a buydown account. A portion of this sum is released each month to reduce the borrower’s monthly payments.

Contact E5 Home Loans for any questions or to start the process and see what you qualify to borrow. Even if you have previously been denied a pre-qualification, get a Second Opinion with E5 Home Loans. E5 shops loan products across many lenders and we don’t charge a bunch of crazy fees.