Mortgage Rates – A Historical Perspective

We’ve been getting a lot of questions about rates and where they’re going

It’s a good time to reflect on where rates have been historically…not recently. A couple of weeks ago, we talked about the changing housing market and how sudden it is shifting. By sudden, I mean in the blink of an eye. Rates were the first to begin moving quickly, with January ushering in the departure of 3% mortgage rates. June touched a 6% rate on 30-yr fixed mortgages for borrowers with excellent credit. The housing market is following suit with demand dropping and supply tripling in a matter of weeks.

A friend, that is not in the business, shared a housing article with me from Time magazine. When I read the piece, it was a week old and referenced how low the housing supply is. I responded with “old news.” Those supply constraints are loosening with listings rising 300% in some categories, days on market jumping from 8 to 12, and price reductions spiking as well.

It prompted some nostalgia. Not just pre-pandemic nostalgia. Not even Y2K nostalgia. We’re talking about before TopGun coming out the first time. Back when the country was woke, inflation & gas prices were high, and we were worried about Russia. Seems like yesterday. Literally.

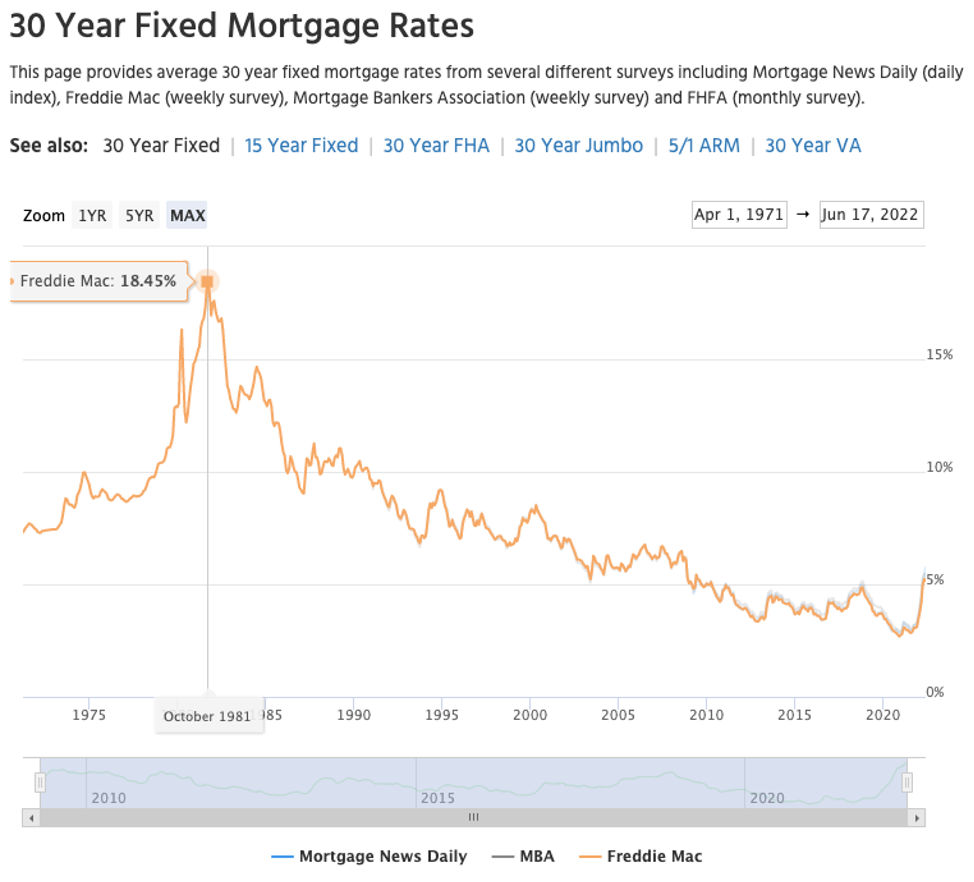

So I pulled the historical mortgage rates going back 50 years.

Here is the 50-year chart and the most notable takeaways:

- Rates peaked as high at 18.45% in October 1981

- Until 2010, there was barely any time rates dipped below 5%

- The end of 2020/beginning of 2021 was the bottom

- Just as rates didn’t stay long at the top, they didn’t stay long at the bottom. We were only below 4% for a few years and we weren’t above 15% more than 18 months at a time.

A Good Place

All in all, mortgage rates are not in a “bad” place, nor are they historically high. They are higher than they have been very recently. However, this is a return to normal, just as the housing market is moving from its frenzy back to a more normal supply and demand market.

Realtors may have to hold some open houses and begin to leverage their expertise and creativity, just as we’re doing at E5 Home Loans. We’re happy to work that open house with you and even find some creative financing options for the seller looking to move, and even potential buyers at the open house. We take less margin to offer lower rates for a more affordable housing payment. And as always, with 5-star service and without a bunch of crazy fees. Call us to learn more.