How Much Can I Afford?

There’s common sense and there are lending requirements when you go to determine how much home you can afford to buy. We strongly encourage borrowers to set their own limit on a monthly payment amount before even beginning to get prequalified. By analyzing your budget, income and monthly bills, you will set your comfort zone for a monthly payment.

How High Can My Payment Be and How Much House Does That Buy?

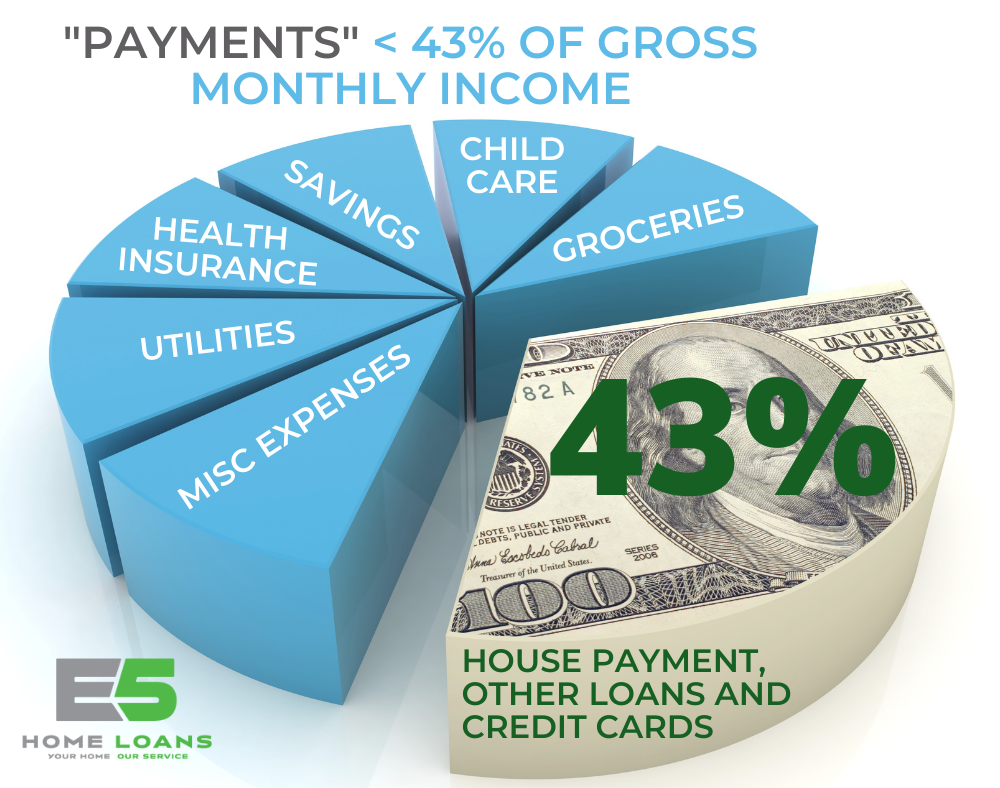

When it comes to lending requirements, think 43% to qualify. This number is your debt-to-income ratio (DTI), and 43% represents the general industry standard for a home loan applicant’s total maximum DTI. We’ll explain how to determine your DTI and give you an example of how to calculate how much house you can buy.

What makes up my Debt-to-Income (DTI)?

The DTI percentage is calculated by comparing a total of all monthly “payments,” including the proposed house payment, with an applicant’s total gross monthly income. It’s important to understand this 43% to qualify does NOT take into account all your monthly “expenses.”

For the “Income” part of DTI, take your current gross monthly salary, or annual salary divided by 12. The number to use is “gross,” meaning before any taxes or deductions (after-tax income is referred to as “net”).

Example: Your salary is $75,000/year, or you make $36.05/hr in a 40-hr work week. Your gross monthly income is about $6,250, regardless of what goes into your bank account after you take out taxes and insurance. $6,250 is your Gross Monthly Income.

Included in DTI Debt (Your “Payments”)

- Your monthly proposed housing payment, including:

- Principal & Interest

- Property taxes

- Homeowners insurance

- Monthly HOA fees

- Any additional credit/loan commitments, including:

- Automobile loan monthly payments

- Student loan monthly payments

- Credit cards or revolving debt (minimum monthly payments)

- Other mortgages

- Child Support/Spousal Maintenance monthly commitments

- IRS Payments

Not included in your DTI Debt (Your “Expenses”)

- Automobile insurance & maintenance

- Utilities (water, electric, internet, gas, phone)

- Savings contributions

- Health insurance

- Groceries

- Child care/tuition

While these “Expenses” do not contribute to the 43%, you may want to consider these when making your budget. Another percentage to consider is the 28% rule that states you should spend 28% or less of your monthly gross income on your mortgage payment (e.g. principal, interest, taxes and insurance).

Here is a simple example:

Homebuyer A

- $75,000 Annual salary

Gross monthly income = $6,250

- $400 car payment

- $100 student loan payment

- $50 “minimum” monthly credit card payment.

Total monthly payments = $550

43% of $6,250 = $2,688

$2,688 (43% DTI) – $550 (payments) = $2,138

$2,138 represents the maximum house payment that Homebuyer A can qualify for including principal & interest, property taxes, insurance, and homeowner’s association dues.

With an interest rate of 3.750% APR, and contributing closing costs and a 10% down payment, Homebuyer A could afford a $400,000 home.

NOTE: $2,138 is 34% of Homebuyer A’s DTI, 6% above the 28% rule. This is where we encourage borrowers to ensure their monthly budget determines what they are comfortable paying, not just how much they qualify to borrow.

The best advice that you can follow is to set your own budget and then speak to an E5 licensed loan officer. Prior to getting prequalified, use the method above, along with a mortgage calculator, to get an idea of what loan amount corresponds to a specific payment.

If you have any questions or are curious to see what you could qualify to borrow, contact E5 Home Loans. Even if you already have a quote or prequalification, reach out to us for a Second Opinion. E5 Home Loans shops for the best products across many lenders and we don’t charge a bunch of crazy fees.