A Guide to Seller Concessions

Seller concessions are growing in popularity as we move to a balanced housing market. Sellers saw buyers paying $10,000 over list price a few months ago to seeing a median price reduction last week of $10,100. What might be more surprising is only 15.9% of active listings in Phoenix, AZ had price reductions. However, 44.5% of closings had seller concessions.

Why are seller concessions offered?

In response to higher mortgage rates, 2-1 buydown loans make payments more affordable with temporary subsidies lowering payments for the first 2 years of the loan. Click here to learn how 2-1 Buydowns work.

Lower out-of-pocket cost for buyers is another benefit of seller concession. A $10,000 price reduction on a $500,000 home might only save a buyer $45/mo and maybe $2,000 cash. Meanwhile, a $10,000 concession could save a buyer $10,000 in cash…depending on the loan.

Seller Concessions Guide

With the rise in seller concessions, E5 Home Loans has some guidance for borrowers to understand the options, but also tips on how to maximize the cash savings.

As mentioned, a seller might offer a $10,000 concession, but can the borrower use all those funds to cover closing costs of the loan? That varies based on the type of cost, loan program, down payment amount, contribution type, and property type.

It’s important to know seller concessions can only cover the following items:

- Closing costs – this can include any lender fees (which E5 does NOT charge), or Title fees.

- Prepaid items – these include prepaid property taxes and homeowners insurance

- Discount points – this is the cost to buydown to a lower rate

- *Debt payoff (VA LOANS ONLY)

Loan Types

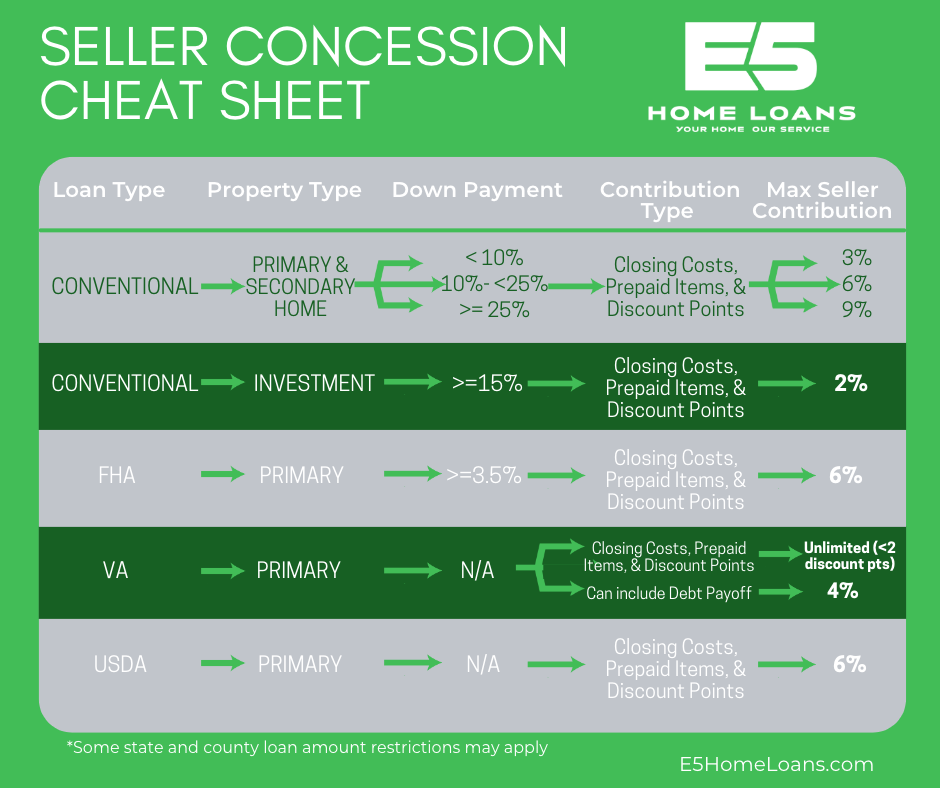

The amount of seller concessions allowed depends on the loan type and down payment amount.

A conventional loan on a primary or second home has maximum seller contributions based on down payment amount. For example:

- < 10% down payment = 3% maximum seller contribution

- 10 – 25% down payment = 6% maximum seller contribution

- > 25% down payment = = 9% maximum seller contribution

A conventional loan on an investment property has a maximum seller contribution of 2% regardless of down payment.

FHA = 6% maximum seller contribution

VA loans have a 4% maximum seller contribution. The costs subject to the 4% limit are different than other loan types. The VA specifically says, “Do not include normal discount points and payment of the buyer’s closing costs in total concessions for determining whether concessions exceed the four percent limit.”

There is no limit for normal and customary closing costs, prepaid items & discount points. However, the VA does allow seller contributions to cover the following:

- VA funding fee

- Gifts like a TV or appliances

- Payoff of credit balances or judgments on behalf of the buyer

These contributions are subject to the 4% limit.

E5 Home Loans highly recommends buyers have strong to quite strong communication between the loan officer and realtor prior to making an offer on a home. At the very least, consult your loan officer prior to negotiating the final terms of the purchase contract.

To see what you might qualify to purchase or for any questions regarding seller concessions, contact E5 Home Loans. You will automatically save on closing costs, because E5 Home Loans doesn’t charge a bunch of crazy lender fees.