Credit Score: What makes up your FICO score

Your credit score can mean the difference between qualifying for a home loan or being denied. Even more so, it can impact the interest rate you might qualify to receive. So, what makes up your credit score?

Your FICO score is a three-digit number generated by a mathematical algorithm using your prior payment history as a benchmark, which is detailed in your credit report. It’s designed to predict risk, specifically, the likelihood that you will become seriously delinquent on your credit obligations in the 24 months after scoring.

What is FICO?

There are a multitude of credit scoring models in existence, but one dominates the market — the FICO credit score. FICO, originally Fair, Isaac and Company, is a data analytics company. According to myFICO.com, the consumer website for the FICO score developer, “90 percent of all financial institutions in the U.S. use FICO scores in their decision-making process.”

What’s a good score?

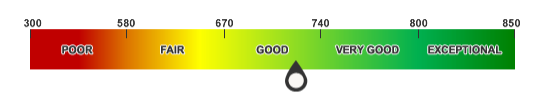

FICO scores range from 300 to 850. A higher number indicates lower risk.

What makes up my score?

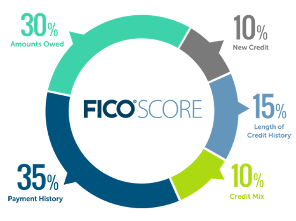

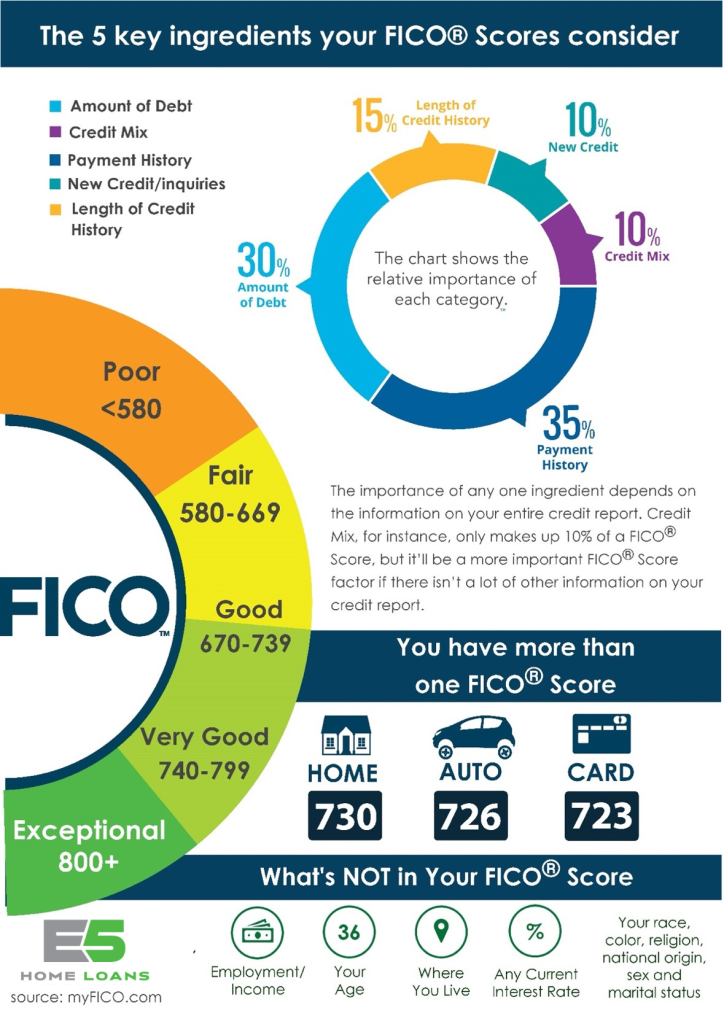

The scoring model weighs some factors more heavily, such as payment history and debt owed.

- Payment history: (35 percent) — Your account payment information, including any delinquencies and public records.

- Amounts owed: (30 percent) — How much you owe on your accounts. The amount of available credit you’re using on revolving accounts is heavily weighted.

- Length of credit history: (15 percent) — How long ago you opened accounts and the time since account activity.

- Types of credit used: (10 percent) — The mix of accounts you have, such as revolving and installment.

- New credit: (10 percent) — Your pursuit of new credit, including credit inquiries and the number of recently opened accounts.

Personal or demographic information such as age, race, address, marital status, income, and employment don’t affect the score.

I applied for an auto loan and they said my score was higher?

You have more than one FICO Score. Depending on what type of credit you’re seeking, your lenders may evaluate your credit risk using different FICO Score versions. Auto lenders, for instance, often use FICO® Auto Scores, an industry-specific FICO Score version that’s been tailored to their needs. For a mortgage or home equity loan application, however, lenders usually take into account a FICO Scores from each of the three credit bureaus, then use the middle score.

How do I check my credit score?

Federal law mandates the consumer has a right to a free credit report annually from each credit reporting agency, but not to a free credit score. If you apply for a home loan, your lender will require some personal information and your consent to pull credit. A credit report is required with any mortgage application and the fee for the credit report will be included in the closing costs for your loan.

What to know about rate shopping (from FICO)

It’s common for borrowers to fear lowering their score from multiple inquiries when shopping rates. myFICO.com provides information on how credit inquiries affect your score. Specific to mortgage inquiries, within 30 days, these won’t affect your scores.

FICO writes, “Research has indicated that FICO Scores are more predictive when they treat loans that commonly involve rate-shopping, such as mortgage, auto and student loans, in a different way. For these types of loans, FICO Scores ignore inquiries made in the 30 days prior to scoring. So, if you find a loan within 30 days, the inquiries won’t affect your scores while you’re rate shopping.”

Source: myFICO.com