How much does credit score impact a mortgage payment?

Answer: Your credit score has a HUGE impact on your available mortgage rate. To put a dollar figure on that rate difference, a realistic number could be more than $7,000/yr.

Let’s look at a likely home loan scenario. The actual cost difference between a buyer with excellent credit versus someone with fair to good credit is $7,308 per year in mortgage payments.

The Scenario

Let’s assume a buyer is looking to purchase a home priced at the average sale price in the US. We will use a $500,000 purchase price, with a 10% down payment of $50,000 making the total loan amount $450,000. (According to Federal Reserve Economic Data, the median price of houses sold in 2022 is $428,700. The average sales price in the same period is higher, at $507,800).

Credit Score

Credit or FICO scores range from 300 to 850. A higher number indicates lower risk. When applying for a home loan, any score over 740 will be eligible for the lowest possible rate on a particular loan. At the other end, most conventional loan products require a minimum of 620. The following 2 scenarios use 670 for the low FICO score and 740 for the high score.

The Numbers

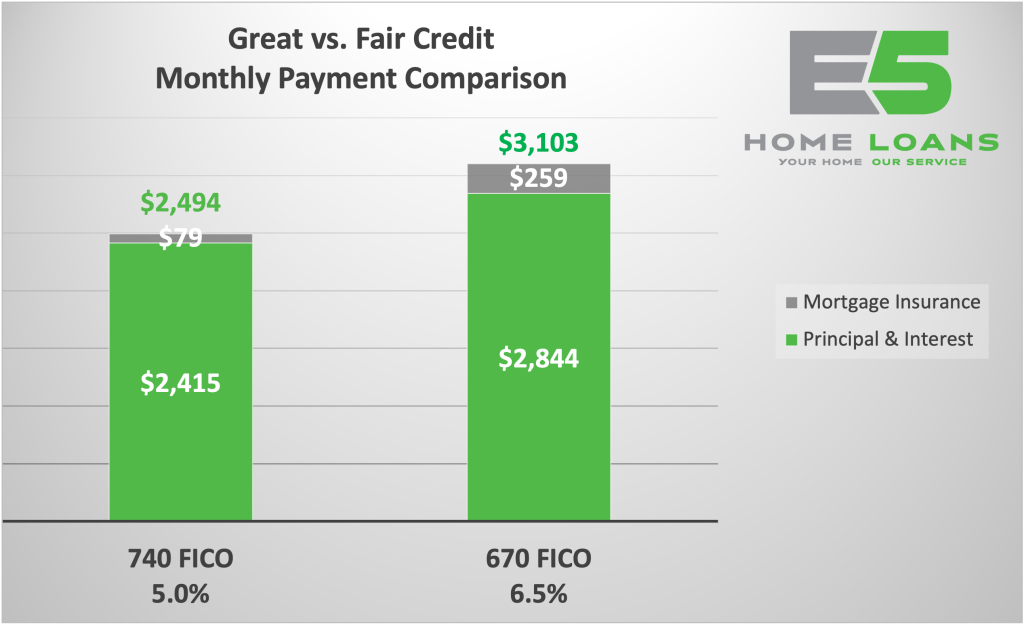

In this scenario, the rate on a 30-year fixed rate mortgage for the excellent buyer (740+ FICO score) is 5.000% (5.173% APR) with a monthly payment of $2,494 (excluding taxes & insurance). The buyer with fair/good credit (670 FICO score) on the same type of mortgage is eligible for a rate of 6.500% (7.016% APR) with a monthly payment of $3,103. That payment is $609 more each month, totaling $7,308 for every year the buyer is in that loan. Not only is the lower FICO score paying more in interest (6.5% vs 5.0%), they are also paying significantly more in Private Mortgage INSURANCE ($259/mo vs $79/mo). Private Mortgage Insurance (PMI) is required by most lenders when putting less than 20% down payment. See the chart below for a breakdown of the payment differences.

What you can do

It’s easy to see how much improving your credit can save when buying a home. It will also save you on other lines of credit including credit cards and auto loans. It can even impact your home and auto insurance rates. But what can you do to improve your credit score for now.

Here are 5 tips to help raise your credit score:

- Make your payments on time. This is THE most important thing. It accounts for 35% of your score.

- It’s okay to use credit cards but carrying a high balance (balances over 30% of the limit, and especially close to your maximum credit limit) can have a negative impact on your score. The amount of credit you use is 30% of your score. E5 Home Loans has tools to evaluate your credit lines and determine how much your score can improve by paying down the balance on certain cards versus others.

- Did we mention making your payments on time? Specifically, avoid being late for a rent or mortgage payment. Most lenders provide a 15-day grace period without penalty. After 15-days, you can be considered late and may be charged a late fee. After 30-days, you are considered late and can increase the negative impact to your credit score.

- If you don’t have any credit cards, it may be worth getting one. Simply make a charge and pay it off at the end of the month. This demonstrates your ability to pay on time. (see #1 and #3)

- Be mindful of the number of accounts. If you have a number of credit cards, you don’t need to close them. Carrying a zero balance doesn’t hurt, while having a mix of available credit helps. However, inquiring about and opening a bunch of new lines can hurt credit scores in the short term.

The last piece of advice is to consult with E5 Home Loans prior to shopping for a new home or refinancing. Not only can one of our experienced loan officers help with a prequalification and a rate quote, they can also let you know specific strategies to improve your individual credit scenario.

If you have any questions about reviewing your credit or are curious to see what you could qualify to borrow, contact E5 Home Loans. Even if you already have a quote or prequalification, reach out to us for a Second Opinion. E5 Home Loans shops for the best products across many lenders and we don’t charge a bunch of crazy fees.