What is a Temporary Buydown?

A buydown allows a borrower to obtain a lower interest rate, for a period of time, by prepaying some of the interest on the loan. Typically, the seller of a property provides a lump sum concession (prepaid interest) that is held in a custodial escrow account and applied each month to the borrower’s subsidized payment. The borrower may pay all or a portion of the buydown amount as well.

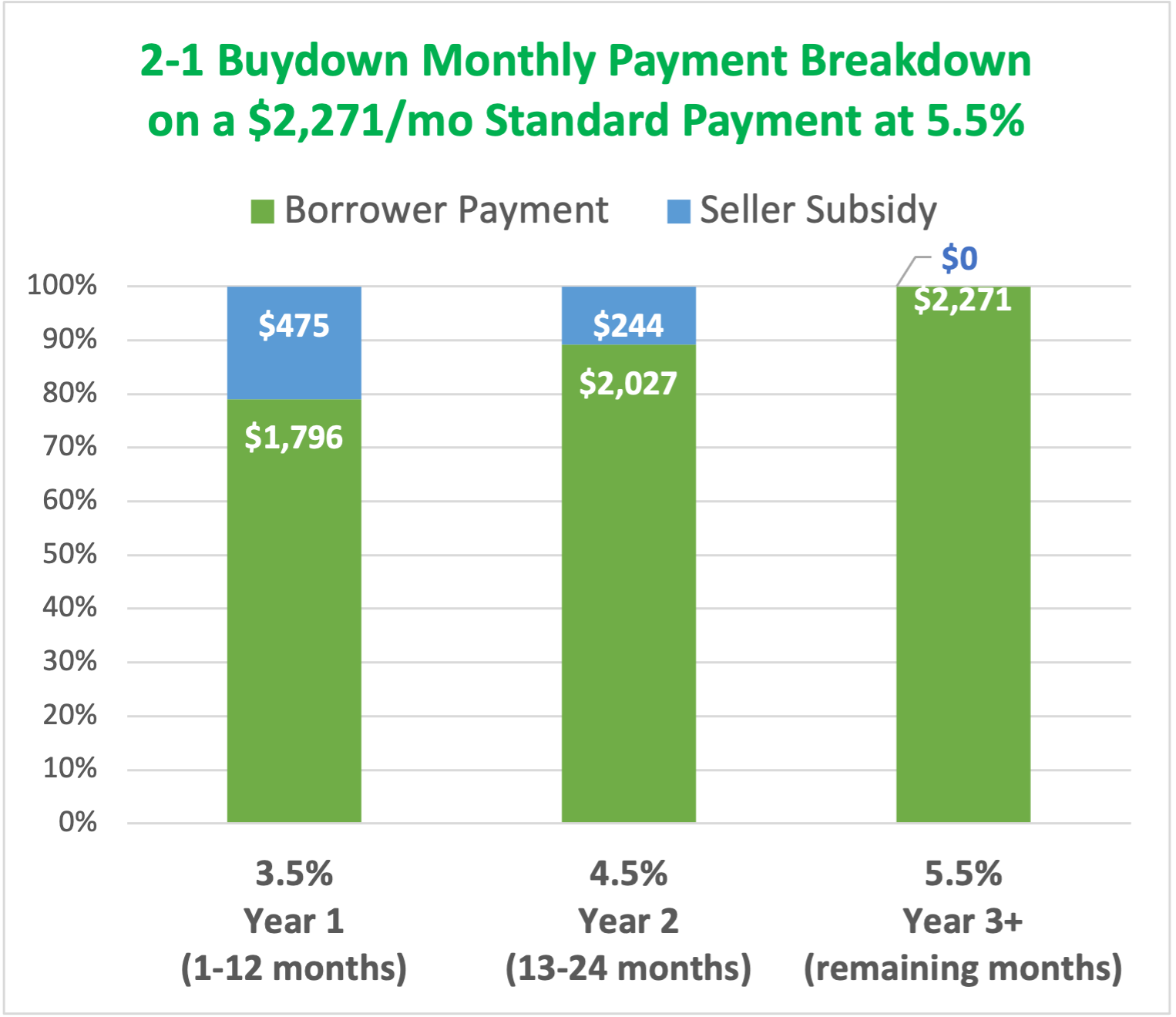

- A 2-1 buydown lowers the interest rate on a mortgage for the first two years before rising to the permanent rate.

- The rate is typically two percentage points lower during the first year and one percentage point lower in the second year.

- A 2-1 buydown can benefit home buyers, provided they are able to afford the higher permanent monthly payments once those begin.